Enterprise budgets are a supply of fact to your earnings and bills. That features all the cash you spend — from A/B testing your advertising campaigns to your month-to-month workplace hire.

In my roles, I’ve wanted to create budgets for entire initiatives and smaller writing initiatives.

Whereas organizing the numbers might sound tough, I’ve discovered that utilizing a enterprise finances template makes the method easy. Plus, there are literally thousands of enterprise finances templates so that you can select from.

On this article, I’ll share seven finances templates that may assist manage your funds. However first, you’ll find out about several types of enterprise budgets and how one can create one.

Desk of Contents

What’s a enterprise finances?

A enterprise finances is a spending plan that estimates the income and bills of a enterprise for a time frame, usually month-to-month, quarterly, or yearly.

The enterprise finances follows a set template, which you’ll be able to fill in with estimated revenues, plus any recurring or anticipated enterprise bills.

For instance, say what you are promoting is planning a web site redesign. You’d want to interrupt down the prices by class: software program, content material and design, testing, and extra.

Having a transparent breakdown will make it easier to estimate how a lot every class will price and evaluate it with the precise prices.

Forms of Budgets for a Enterprise

- Grasp Price range

- Working Price range

- Money Price range

- Static Price range

- Departmental Price range

- Capital Price range

- Labor Price range

- Undertaking Price range

Enterprise budgets aren’t one measurement matches all. In reality, there are a lot of several types of budgets that serve varied functions.

Let’s dive into some generally used budgets:

Grasp Price range

Consider a master budget because the superhero of budgets.

It brings collectively all the person budgets from completely different elements of your organization into one huge, consolidated plan. It covers every part from gross sales and manufacturing to advertising and funds.

It contains particulars like projected revenues, bills, and profitability for every division or enterprise unit. It additionally considers essential monetary facets like money circulate and capital expenditures. The finances even creates a stability sheet to point out the group’s monetary place.

The grasp finances acts as a information for decision-making, helps with strategic planning, and provides a transparent image of the general monetary well being and efficiency of your organization. It is just like the grasp plan that ties every part collectively and helps the group transfer in the fitting course.

Working Price range

Your working finances helps your organization work out how a lot cash it expects to make and spend throughout a particular interval, normally a 12 months. It not solely predicts the income what you are promoting will herald but additionally outlines bills it might want to cowl, like salaries, hire, payments, and different operational prices.

By evaluating your precise bills and income to the budgeted quantities, your organization can see the way it’s performing and make changes if wanted. It helps hold issues in verify, permitting what you are promoting to make clever monetary choices and keep on monitor with its targets.

Money Price range

A money finances estimates the money inflows and outflows of what you are promoting over a particular interval, usually a month, quarter, or 12 months. It supplies an in depth projection of money sources and makes use of, together with income, bills, and financing actions.

The money finances helps you successfully handle your money circulate, plan for money shortages or surpluses, consider the necessity for exterior financing and make knowledgeable choices about useful resource allocation.

By using a money finances, what you are promoting can guarantee it has sufficient money available to satisfy its monetary obligations, navigate fluctuations, and seize development alternatives.

Static Price range

A static budget is a monetary plan that continues to be unchanged, no matter precise gross sales or manufacturing volumes.

It’s usually created in the beginning of a finances interval and doesn’t account for any fluctuations or modifications in enterprise situations. It additionally assumes that each one variables, resembling gross sales, bills, and manufacturing ranges, will stay the identical all through the finances interval.

Whereas a static finances supplies a baseline for comparability, it will not be real looking for companies with fluctuating gross sales volumes or variable bills.

Departmental Price range

A departmental finances focuses on the monetary facets of a particular division inside your organization, resembling gross sales, advertising, or human assets.

When making a departmental finances, it’s possible you’ll take a look at income sources like departmental gross sales, grants, and different sources of earnings. On the expense facet, you take into account prices resembling salaries, provides, gear, and every other bills distinctive to that division.

The objective of a departmental finances is to assist the division handle its funds properly. It acts as a information for making choices and allocating assets successfully. By evaluating the precise numbers to the budgeted quantities, division heads can see in the event that they’re on monitor or if changes must be made.

Capital Price range

A capital budget is all about planning for giant investments in the long run. It focuses on deciding the place to spend cash on issues like upgrading gear, sustaining amenities, growing new merchandise, and hiring new staff.

The finances appears on the prices of shopping for new stuff, upgrading present issues, and even considers depreciation, which is when one thing loses worth over time. It additionally considers the return on funding, like how a lot cash these investments may herald or how they might save prices sooner or later.

The finances additionally appears at other ways to finance these investments, whether or not it‘s by means of loans, leases, or different choices. It’s all about making sensible choices for the longer term, evaluating money circulate, and selecting investments that may assist the corporate develop and succeed.

Labor Price range

A labor finances helps you intend and handle the prices associated to your staff. It entails determining how a lot what you are promoting will spend on wages, salaries, advantages, and different labor-related bills.

To create a labor finances, you‘ll want to think about elements like how a lot work must be carried out, what number of people you’ll must get it carried out, and the way a lot it’s going to all price. This can assist what you are promoting forecast and management labor-related bills and guarantee enough staffing ranges.

By having a labor finances in place, what you are promoting can monitor and analyze your labor prices to make knowledgeable choices and optimize your assets successfully.

Undertaking Price range

A venture finances is a monetary plan for a particular venture.

Let‘s say you may have an thrilling new venture you wish to sort out. A venture finances helps you determine how a lot cash you’ll want and the way it will likely be allotted. It covers every part from personnel to gear and supplies — principally, something you may must make the venture occur.

By making a venture finances, you may make positive the venture is doable from a monetary standpoint. It helps you retain monitor of how a lot you deliberate to spend versus how a lot you really spend as you go alongside.

That approach, you may have a transparent thought of whether or not you are staying on monitor or if there are any monetary challenges that want consideration.

Tips on how to Create a Enterprise Price range

Whereas making a business budget might be simple, the method could also be extra complicated for bigger firms with a number of income streams and bills.

Irrespective of the scale of what you are promoting, listed below are the fundamental steps to making a enterprise finances.

1. Collect monetary knowledge.

Earlier than you create a enterprise finances, it’s essential to collect insights out of your previous monetary knowledge. By taking a look at earnings statements, expense stories, and gross sales knowledge, you’ll be able to spot traits, be taught from previous experiences, and see the place you may make enhancements.

Going by means of your monetary historical past helps you paint an correct image of your earnings and bills. So, once you begin creating your finances, you’ll be able to set achievable targets and ensure your estimates match what’s really been taking place in what you are promoting.

In addition to previous financials, take into account new bills. For example, if what you are promoting is trying to attempt a brand new advertising channel, you’d must doc your targets for that channel. Afterward, stroll backward to determine how a lot you might want to obtain these targets and embody it in your finances.

2. Discover a template or make a spreadsheet.

There are lots of free or paid finances templates on-line. You can begin with an present finances template. We listing just a few useful templates beneath.

You may additionally choose to make a spreadsheet with customized rows and columns based mostly on what you are promoting.

3. Fill in revenues.

After getting your template, begin by itemizing all of the sources of what you are promoting’ earnings. With a finances, you’re planning for the longer term, so that you’ll additionally must forecast income streams based mostly on earlier months or years.

For a brand new small enterprise finances, you’ll depend on your market analysis to estimate early income to your firm. When you’re attempting out new channels, think about using business benchmarks to gauge the income to anticipate.

Once you estimate your revenue, you are primarily determining how a lot cash you need to work with. This helps you resolve the place to allocate your assets and which bills you’ll be able to fund.

4. Subtract fastened prices for the time interval.

Fastened prices are the recurring prices you may have throughout every month, quarter, or 12 months. Examples embody insurance coverage, hire for workplace area, web site internet hosting, and web.

The important thing factor to recollect about fastened prices is that they keep comparatively steady, no matter modifications in enterprise exercise. Even when your gross sales lower or manufacturing slows down, these prices stay the identical.

Nevertheless, it is essential to notice that fastened prices can nonetheless change over the long run, resembling when renegotiating lease agreements or adjusting worker salaries.

5. Think about variable prices.

Variable prices will change every so often. Not like fastened prices, variable costs enhance or lower as the extent of manufacturing or gross sales modifications.

Examples embody uncooked supplies wanted to fabricate your merchandise, packaging and delivery prices, utility payments, promoting prices, workplace provides, and new software program or know-how.

It’s possible you’ll all the time must pay some variable prices, like utility payments. Nevertheless, you’ll be able to shift how a lot you spend towards different bills, like promoting prices, when you may have a lower-than-average estimated earnings.

6. Put aside time for enterprise finances planning.

Sudden bills may come up, otherwise you may wish to save to develop what you are promoting. Both approach, evaluate your finances after together with all bills, fastened prices, and variable prices.

As soon as accomplished, you’ll be able to decide how a lot cash it can save you. It’s clever to create a number of financial savings accounts. One needs to be used for emergencies. The opposite holds cash that may be spent on the enterprise to drive development.

7. Conduct finances critiques.

Each finances requires periodic critiques. Common critiques let you recognize what’s working and reply to modifications in your monetary outlook.

When doing a finances evaluate, evaluate your estimated finances to your precise spend. This lets you know the way to make higher income and expense projections.

There isn’t a rule stating when it’s best to conduct your finances evaluate. Nevertheless, I might advocate you do it month-to-month, quarterly, and yearly.

- Month-to-month critiques: Examine your estimated versus precise spend. Search for objects whose precise spend surpasses the estimated price. Think about cost-cutting measures for such objects when forecasting your bills for the following month.

- Quarterly critiques: Use this evaluate to determine month-over-month finances estimates and precise spend for 3 months. Use the insights to find out what it’s best to spend much less or extra on and forecast higher for the following quarter.

- Yearly critiques: This evaluate allows you to assess your projections for the 12 months. In the event that they have been correct, double down on it. If in any other case, mirror on what didn’t work and use what you’ve realized to make higher long-term monetary projections for the following 12 months.

Tips on how to Handle a Enterprise Price range

There are just a few key elements to managing a wholesome enterprise finances.

Price range Preparation

The method all begins with correctly getting ready and planning the finances in the beginning of every month, quarter, or 12 months.

You may as well create a number of budgets, some short-term and a few long-term. Throughout this stage, additionally, you will set spending limits and create a system to usually monitor the finances.

Price range Monitoring

In bigger companies, you may delegate finances monitoring to a number of supervisors.

However even in the event you’re a one-person present, hold an in depth eye in your finances.

Which means setting a time in your schedule every day or week to evaluate the finances and monitor precise earnings and bills. Make sure to evaluate the precise numbers to the estimates.

Price range Forecasting

With common finances monitoring, you all the time understand how what you are promoting is doing.

Examine in usually to find out how you might be doing when it comes to income and the place you may have losses. Discover the place you’ll be able to decrease bills and how one can transfer more cash into financial savings.

Why is a Price range Vital for a Enterprise?

A finances is essential for companies. With out one, you can simply be drowning in bills or sudden prices.

The enterprise finances helps with a number of operations. You should use a enterprise finances to maintain monitor of your funds, lower your expenses that can assist you develop the enterprise or pay bonuses sooner or later, and put together for sudden bills or emergencies.

You may as well evaluate your finances to find out when to take the following leap for what you are promoting. For instance, you is likely to be dreaming of a bigger workplace constructing or the most recent software program, however you wish to be sure you have a wholesome web income earlier than you make the acquisition.

Greatest Free Enterprise Price range Templates

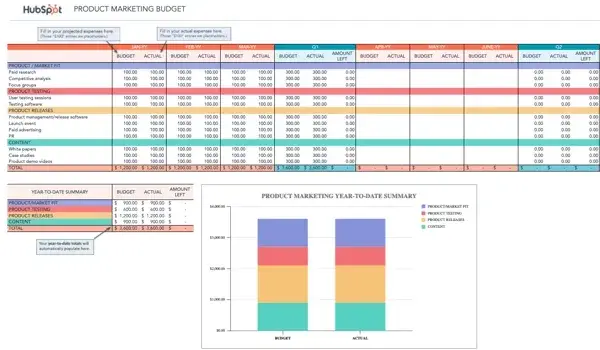

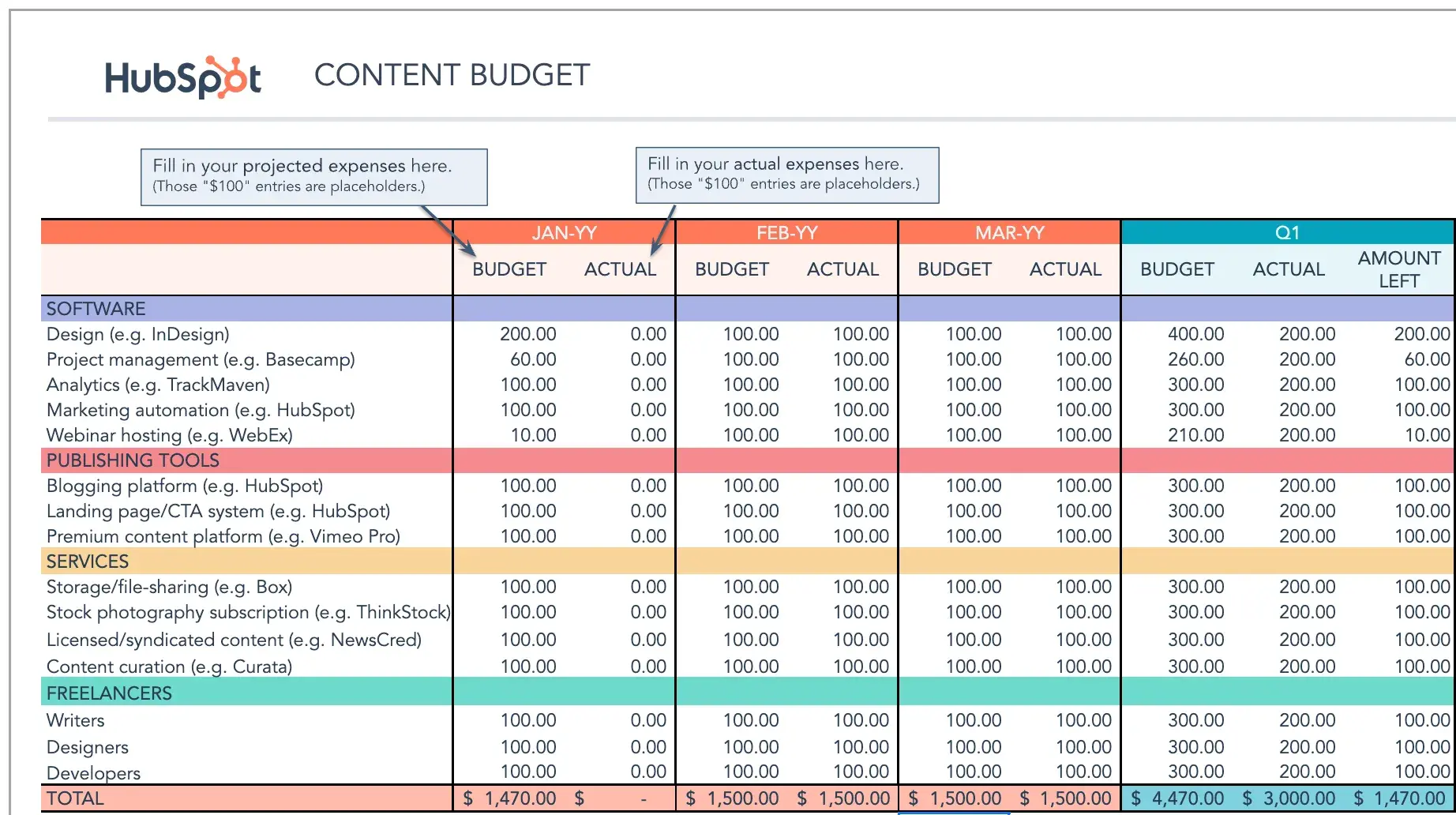

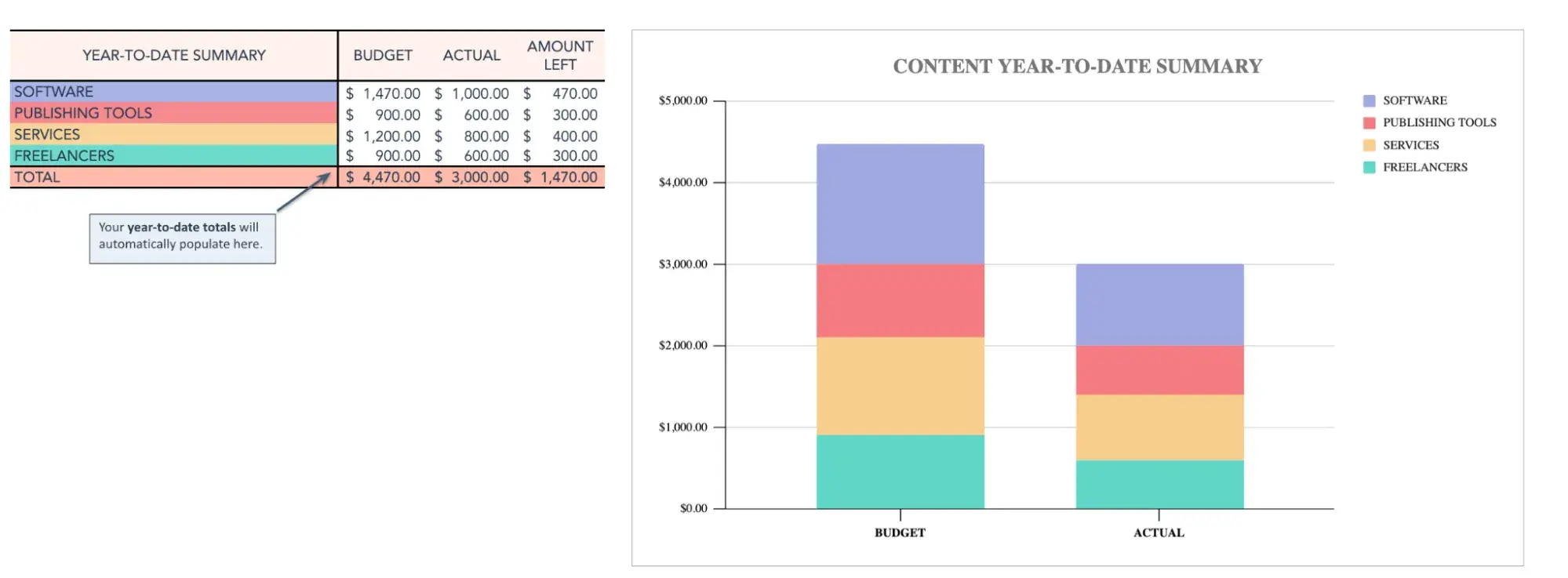

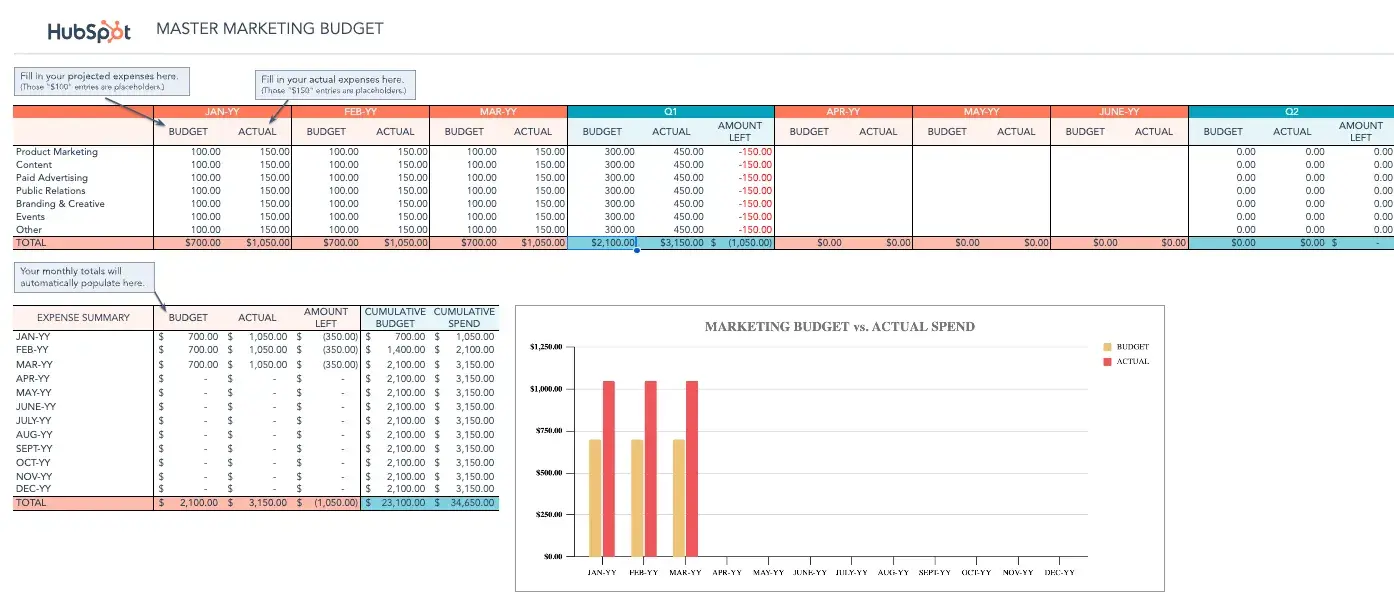

1. Marketing Budget Template

Greatest for: Firms executing a number of initiatives throughout a number of advertising channels

Figuring out how to manage a marketing budget is usually a problem, however with useful free templates like this marketing budget template bundle, you’ll be able to monitor every part from promoting bills to occasions and extra.

I like this bundle as a result of it’s complete and has eight free enterprise finances templates. There are templates for:

- Branding and inventive finances.

- Product advertising finances.

- Paid promoting finances.

- Public relations finances.

- Internet design finances.

- Content material finances.

- Occasion finances.

The grasp finances template brings every part collectively and serves as your single supply of fact. It consolidates the completely different budgets into an enormous, company-wide finances sheet. Having a particular template for every initiative can assist groups hold monitor of spending and plan for development.

2. Project Budget Template

Greatest for: In-house groups searching for buy-in for complicated initiatives

Each new venture comes with bills.

This free business budget template will assist your workforce calculate the entire price when you enter your labor, materials, and glued prices. You may simply spot in the event you’re going over finances halfway by means of a venture so you’ll be able to modify.

This template is particularly helpful for small firms which might be reporting budgets to shoppers and for in-house groups getting buy-in for complicated initiatives.

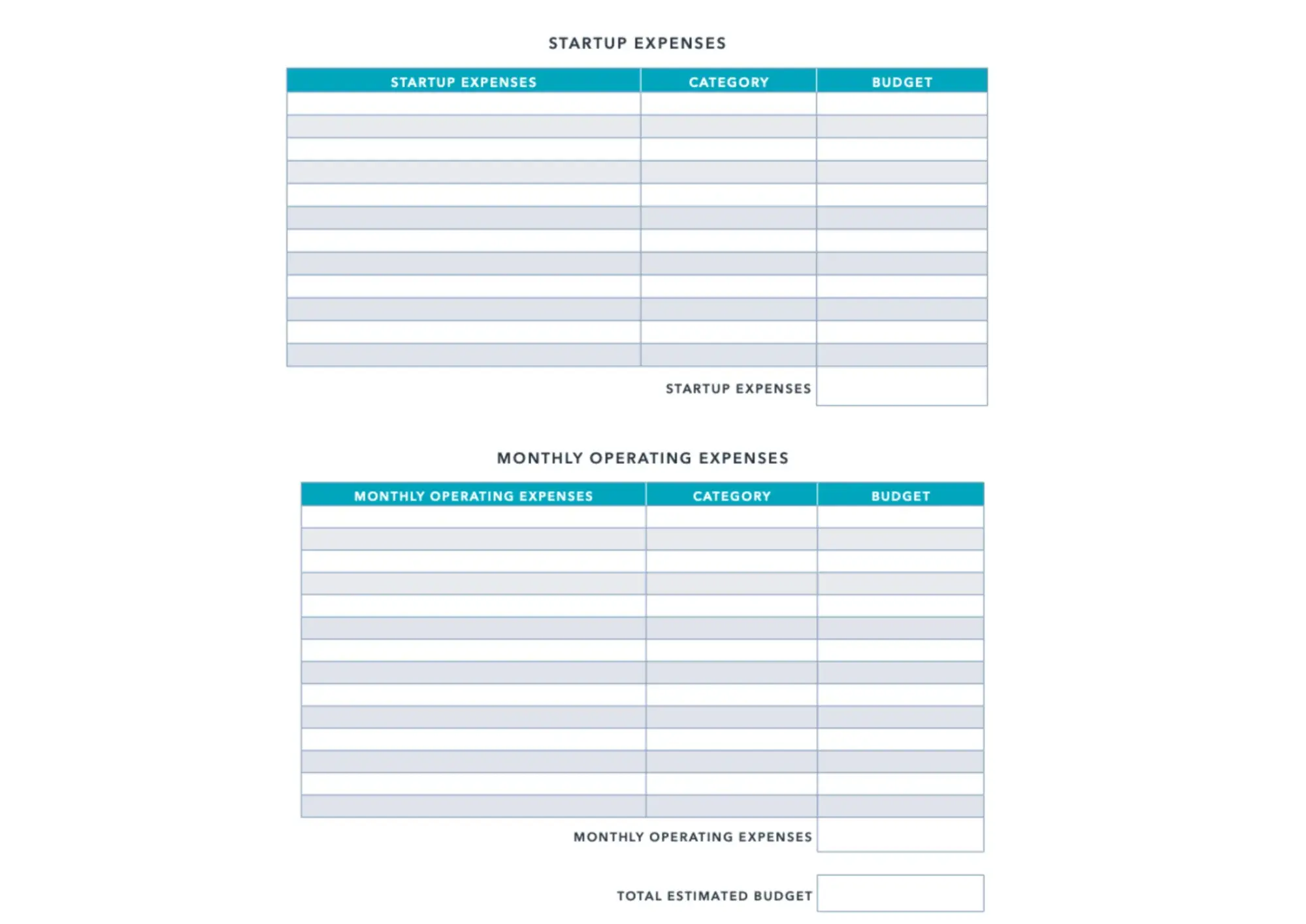

3. Free Business Budget Template

Greatest for: Companies of all kinds executing a minimal variety of initiatives

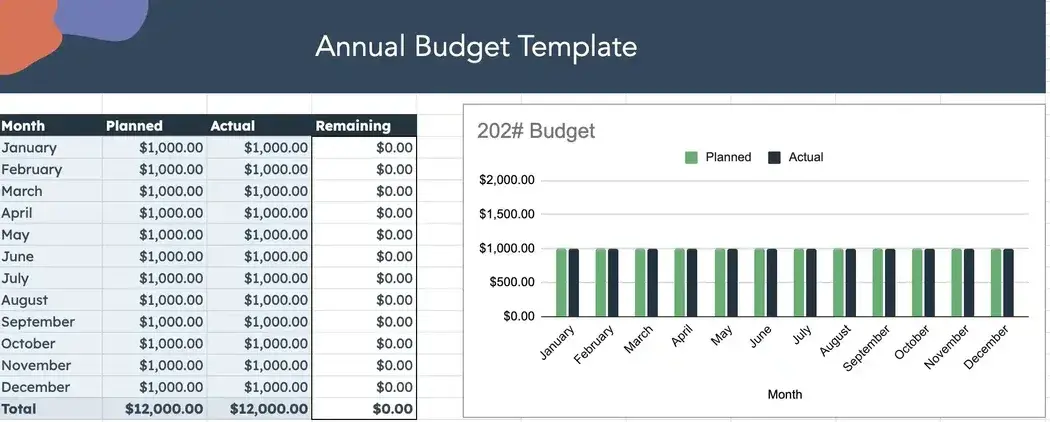

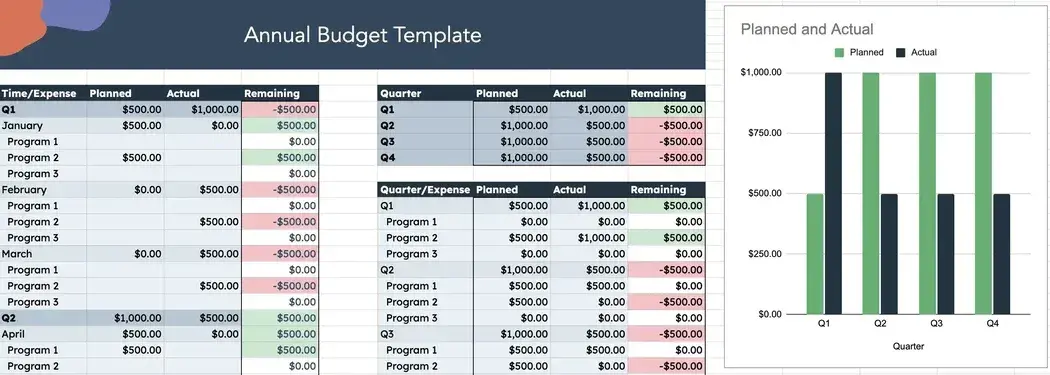

Generally, it’s possible you’ll must doc a easy finances for just a few initiatives. In such circumstances, this free business budget template, which works in Google Sheets and Excel, could also be best. I like the concept of Google Sheets as a result of it lets others collaborate and touch upon the finances.

These enterprise finances templates characteristic cells for getting into your bills, class, and finances. Afterward, the spreadsheet makes use of the information to create your complete estimated finances.

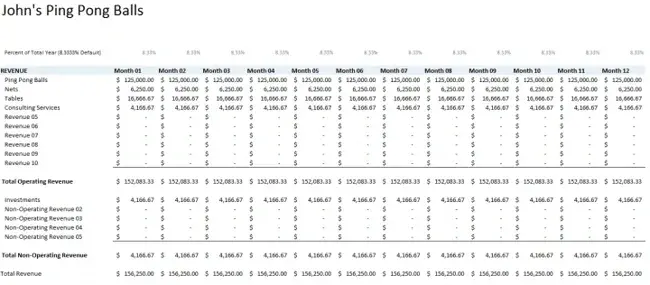

4. Small Business Budget Template

Greatest for: Small companies and new startups

For small companies, it may be exhausting to seek out the time to attract up a finances, nevertheless it’s essential to assist hold the enterprise in good well being. That is why I just like the budget template that Capterra created particularly for small companies.

This enterprise finances template works with Excel. I like this template as a result of it helps you’re taking stock of your earnings and monitor your month-to-month bills. The small enterprise finances template from Capterra contains:

- Working earnings.

- Non-operating earnings.

- Fastened price.

- Variable price.

The enterprise expense part of the template is superb for monitoring worker bills.

The enterprise finances part of the template helps you monitor your estimated versus precise earnings. Over time, this data helps you are expecting the earnings to anticipate so you’ll be able to plan your bills and have the funds to execute.

To make use of the enterprise finances template, begin by inputting your estimated projections. When you get the precise figures, enter them, and the sheet will calculate the remainder mechanically.

For the enterprise expense template, you merely enter the outline and related price to get the entire price.

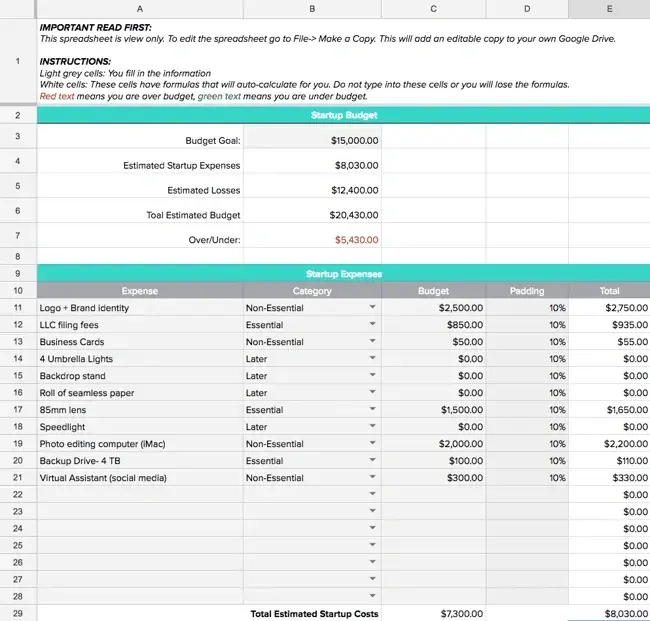

5. Startup Budget Template

Greatest for: New enterprise homeowners and startups

Generally, it’s possible you’ll not have earlier numbers to depend on to create revenue and expense estimates. Belief me, I’ve been there, and that’s the place Gusto’s finances template helps.

In case you are a startup, this budget template will make it easier to draw up a finances earlier than what you are promoting is formally in the marketplace. You may monitor all of the bills you might want to get what you are promoting up and operating, estimate your first revenues, and decide the place to pinch pennies.

Gusto’s enterprise finances template has sections for getting into:

- Expense.

- Expense class.

- Price range.

- Padding.

- Estimated finances.

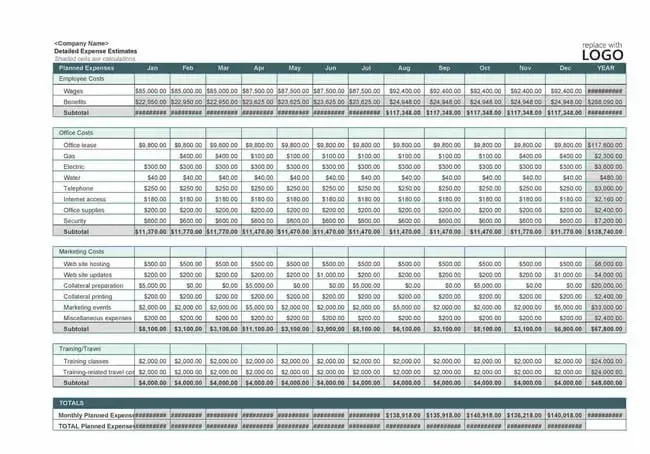

6. Company Budget Template

Greatest for: Firms and small companies with a number of departments

If you wish to hold monitor of each penny, use this template from TemplateLab to attract up an in depth finances. I like this template as a result of it’s complete, lists bills like fastened prices, worker prices, and variable prices.

The expense evaluation part of the template additionally contains pie and bar charts to point out your expenditure visually. This enterprise template is helpful for small companies that wish to hold monitor of bills in a single doc.

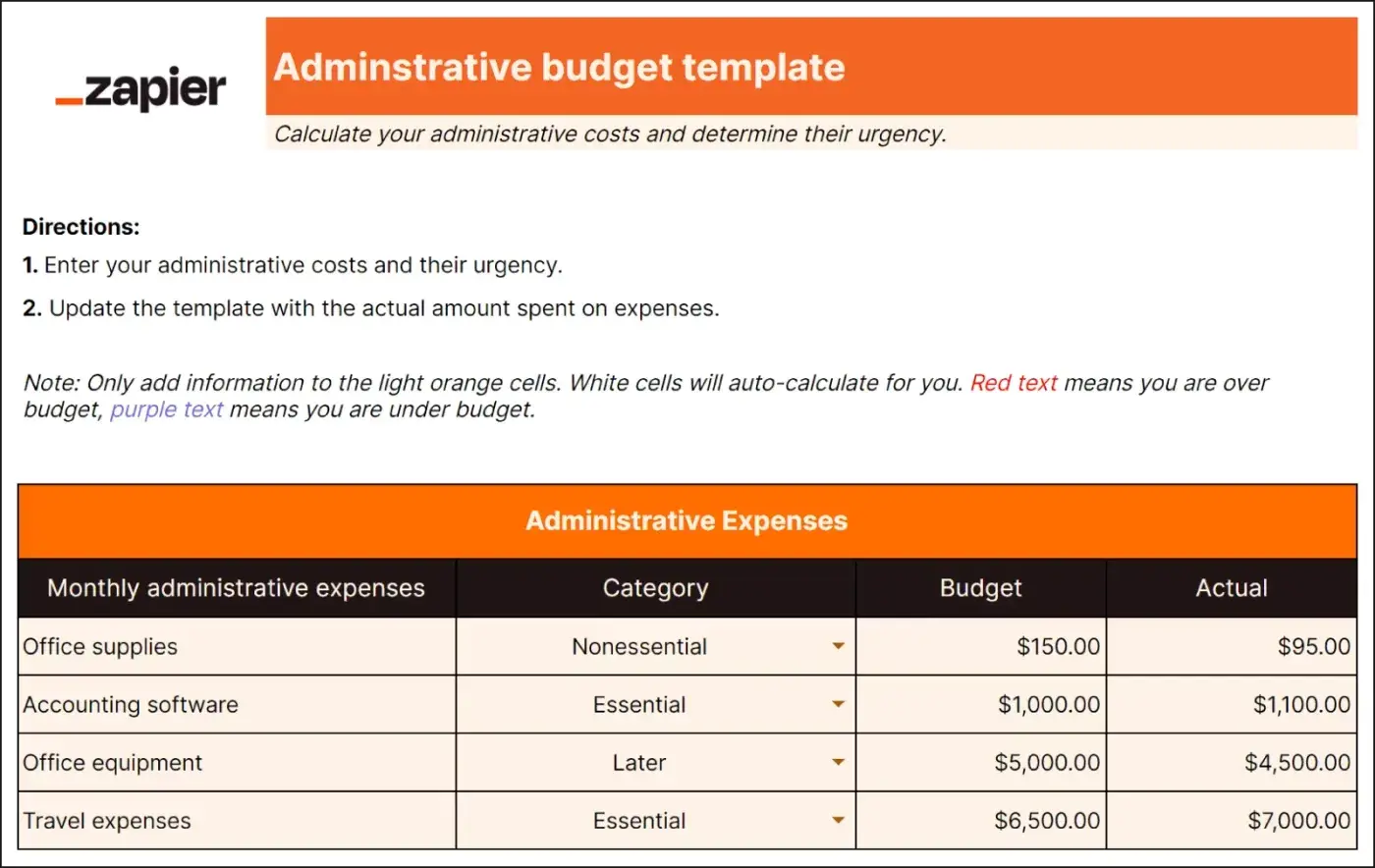

7. Administrative Budget Template

Greatest for: Firms and small companies with a number of departments and huge tech stack

When you function what you are promoting in-office or work remotely with a number of instruments, it could be useful to maintain monitor of your administrative finances individually.

I like this enterprise finances template from Zapier as a result of it allows you to account for administrative bills like:

- Lease.

- Depreciation.

- Insurance coverage.

- Coaching and growth.

- Communication.

- Advertising instruments.

- Gross sales instruments.

- Accounting charges.

Monitoring these bills individually helps you recognize in the event you’re overspending on sure parts of what you are promoting. It additionally allows you to reduce down on what you are able to do with out and save a few of your income.

Testing It Out

To point out you the way straightforward it’s to make use of these templates, I’ll take a look at out the advertising finances template.

When you download the template, you’ll see the primary sheet, exhibiting you how one can use it.

What I like about this template: As soon as I scroll by means of the sheet, there are populated figures, which I can simply change. For example, to enter my content material finances, I simply must observe the directions of filling in my projected bills.

After every month, I can revisit the template to enter my precise bills. This lets me know if my projections are proper.

A pleasant inclusion on this template is the year-to-date abstract, which constantly updates as I enter or delete figures. The graph can also be a superb contact, because it offers me a digital overview of the place I’m spending extra.

Following the identical course of, I can create a product advertising finances, paid promoting finances, public relations finances, and so forth.

After I end these particular person budgets, I can then populate my grasp advertising finances with insights from all initiatives. Simple peasy!

Create a enterprise finances to assist your organization develop.

Making your first enterprise finances might be daunting, particularly when you’ve got a number of income streams and bills. Utilizing a finances template could make getting began straightforward. And, when you get it arrange, these templates are easy to copy.

With little planning and common monitoring, you’ll be able to plan for the way forward for what you are promoting.

Editor’s notice: This submit was initially revealed in September 2021 and has been up to date for comprehensiveness.