Need to cease losing advert {dollars} on the improper clients? Find out how RFM evaluation can rework your PPC retargeting by figuring out your most useful audiences – from VIP clients to these vulnerable to churning – and tailor your campaigns for max ROI.

What’s an RFM evaluation?

In a nutshell, an RFM evaluation helps you classify clients based mostly on their buying habits.

RFM stands for:

- Recency.

- Frequency.

- Financial worth.

Recency

How way back did the shopper final make a purchase order? The newer the acquisition, the extra lively the shopper is taken into account, growing your probabilities of efficiently re-engaging with them.

Frequency

What number of gross sales did these clients make over a given interval? Once more, the upper the acquisition frequency, the extra loyal the purchasers and the upper the lifetime worth (LTV).

Financial worth

How a lot do these clients spend per buy, on common? As soon as extra, the upper that quantity, the extra beneficial the purchasers.

Why RFM segmentation issues

In a super world, all of your clients would buy not too long ago, steadily and with a excessive common order worth. Nevertheless, actuality hardly ever aligns with this good situation.

That’s the place RFM segmentation is available in – analyzing clients’ buy historical past to prioritize sure teams, tailor messaging and create focused retargeting lists for simpler campaigns.

Right here is an instance of a really fundamental RFM segmentation:

| Segments | Recency | Frequency | Financial Worth |

| VIPs | Not too long ago purchased | Buy steadily | Excessive spender |

| First clients | Not too long ago purchased | Didn’t buy earlier than | Spend reasonably |

| Dangerous clients | Didn’t purchase not too long ago | Don’t buy steadily | Low spender |

From a high-level perspective, operating an RFM evaluation permits for elevated personalization and optimization.

For instance, you possibly can determine your most loyal clients versus these vulnerable to churning. As soon as that’s carried out, you possibly can customise campaigns accordingly (unique advantages, promotions, loyalty applications, and so forth.).

From a PPC, hands-on perspective, listed here are some examples of RFM-based actions:

Higher phase retargeting audiences

- VIPs: Reward latest clients with higher-than-average spend and frequency (VIP occasions, unique offers, early releases, and so forth.).

- Frequent consumers: Exclude high-frequency clients from overly aggressive campaigns to keep away from model fatigue and save on advert budgets.

- Prospects in danger: Reengage previous clients who didn’t purchase not too long ago (win-back, particular affords, and so forth.).

- Dangerous clients: Experiment with previous clients who didn’t repeat buy (diversify merchandise, and so forth.) and probably exclude them altogether.

Improve advert copy and artistic

- Prospects in danger: Swap to extra urgency-driven language to get these previous clients to purchase once more (“20% off now with this advert solely!”).

- VIPs: Use a hotter, extra appreciative tone of voice for loyal clients to maintain a particular relationship (“For Our Greatest Prospects Solely”, and so forth.).

- Low financial worth clients: Exclude persistently low financial worth clients from premium product campaigns.

- Nice clients: Flip nice clients (not fairly VIPs however already exhibiting promising indicators) into ambassadors, encouraging them to go away critiques. Or provide them to enter a loyalty program / membership deal.

Create extra granular seed lists

- Dangerous clients: Exclude Lookalike audiences based mostly off of these clients.

- VIPs: Embrace Lookalike audiences based mostly off of these clients.

When not to make use of an RFM evaluation

Whereas highly effective, similar to any methodology, an RFM evaluation has limits:

Low-frequency merchandise / B2B

Frequency turns into irrelevant for merchandise sometimes bought solely as soon as, resembling funerals or specialised industrial gear, rendering RFM evaluation unsuitable for these instances.

Equally, lengthy B2B gross sales cycles, with their decrease interplay frequency, restrict the effectiveness of this method. In such situations, different segmentation strategies are extra acceptable.

Recurring merchandise

Conversely, with subscription-based providers (i.e., Netflix), recency and frequency can’t matter since they occur by default. As an alternative, monitoring renewal charges or service utilization could have extra worth.

Equally, with extremely seasonal merchandise (i.e., Christmas items resembling reward playing cards), an RFM evaluation will lack depth. As an alternative, it would be best to use seasonal KPIs.

Forecasting outcomes

An RFM evaluation seems to be at historic knowledge and isn’t meant to foretell future habits. If that’s your purpose, you’ll in all probability wish to run regression evaluation or time-series forecasting.

Working an RFM evaluation: What knowledge do you want?

Step one in conducting an RFM evaluation is gathering the required knowledge. At its core, all you want is an easy desk containing:

- Buyer IDs.

- Transaction dates.

- Transaction values.

Whereas further particulars like currencies, product classes or places may be useful, it’s finest to begin with this easy basis.

One difficult facet is figuring out the reference interval. The perfect timeframe is dependent upon your business, product lifecycle and buyer shopping for habits.

Nevertheless, as a result of RFM evaluation depends closely on buy frequency, it might not be appropriate for industries like actual property or automotive gross sales.

On the whole, you must use not less than one to 2 years of information, significantly for steadily bought merchandise.

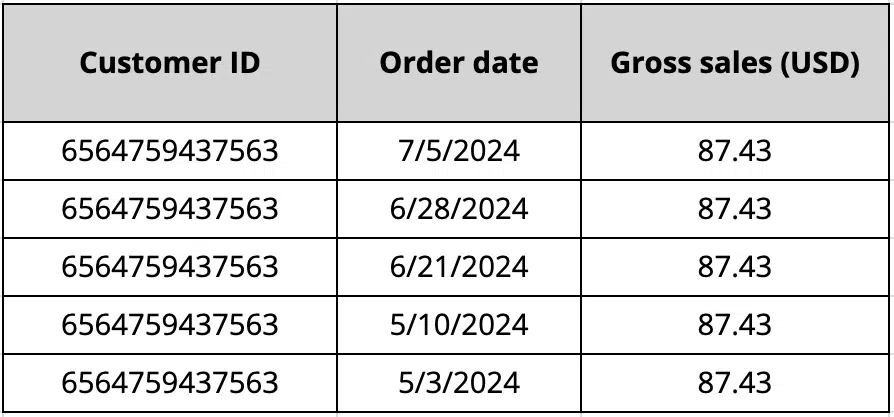

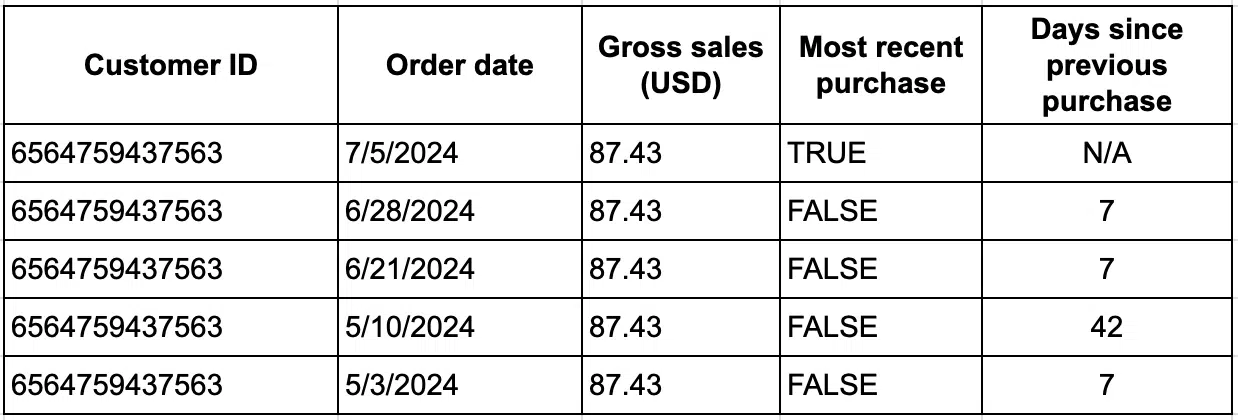

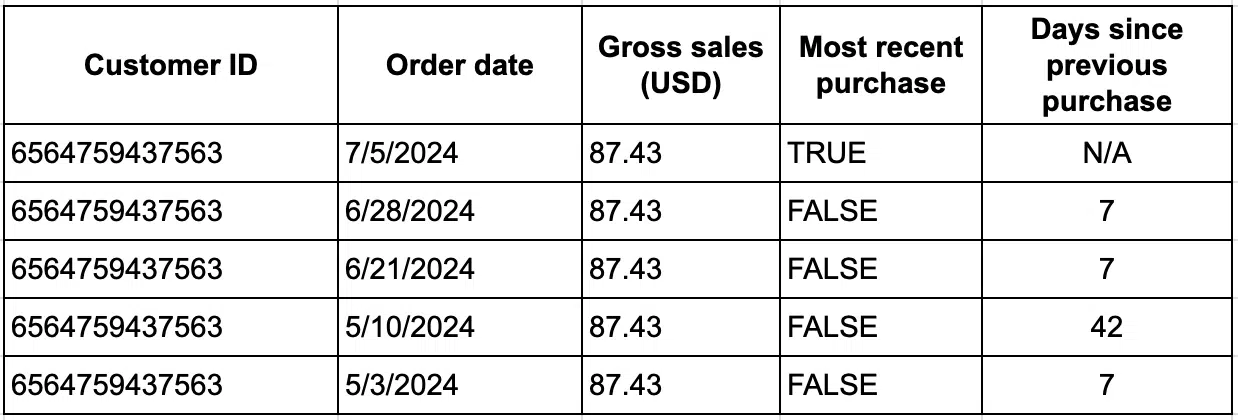

Right here is an instance of such an information pull for a single buyer ID:

Get the publication search entrepreneurs depend on.

The best way to calculate RFM scores

The fantastic thing about RFM evaluation lies in its simplicity. RFM scores are simple to calculate based mostly on three key standards: recency, frequency and financial worth. Listed here are just a few examples:

- Primary: 1 to three rating for every criterion = 27 distinct cells (3 x 3 x 3).

- Considerably refined: 1 to five rating for every criterion = 125 distinct cells (5 x 5 x 5).

- Tremendous refined: 1 to 10 rating for every criterion = 1,000 distinct cells (10 x 10 x 10).

- Tremendous fundamental: 5 major cells (VIP, loyal, huge spenders, new clients, at-risk).

Relying in your wants, superior methods like machine studying or algorithmic approaches can assist decide the optimum variety of segments.

Nevertheless, that’s not the first focus of an RFM evaluation. Its worth lies in being simple and sensible, permitting you to get began rapidly.

Specialised segmentation strategies are sometimes employed for large-scale retailers like Amazon or Walmart. However for now, let’s maintain it easy with a fundamental, concrete instance utilizing Excel.

Recency

Type your desk by buyer IDs after which by date (most up-to-date first).

Add a column to determine whether or not this row is the final buy (a easy IF method will try this trick). Then, add one other column to calculate the quantity of days because the final buy.

Lastly, outline teams based mostly in your venture. For instance:

- Final bought within the final 30 days: 3

- Final bought between 30 and 90 days in the past: 2

- Final bought earlier than that: 1

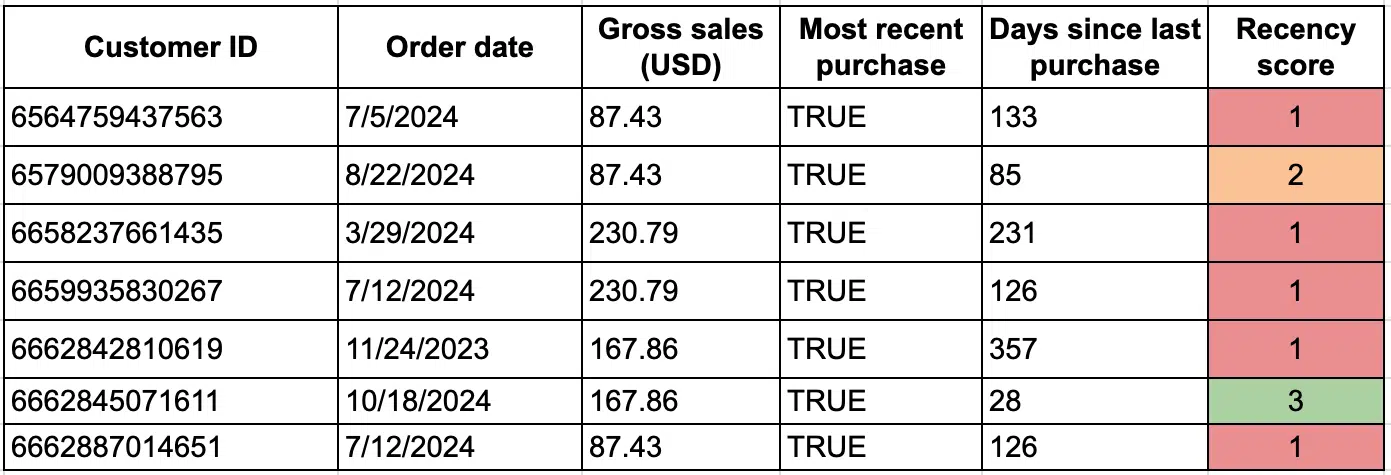

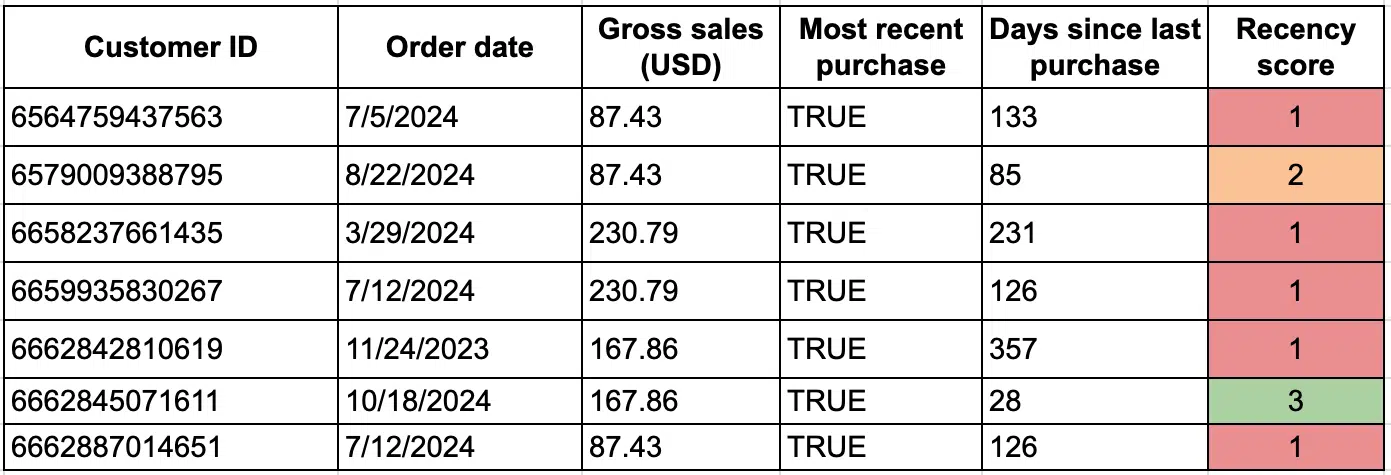

Here’s what it would seem like:

Frequency

Add one other column (“Days since earlier buy”) to your fundamental desk: if it’s the final buy from that buyer ID, skip it.

In any other case, subtract the final buy date from the following buy date. Here’s what it would seem like:

Take your buyer IDs column and replica and paste it elsewhere, then deduplicate it.

Run an AVERAGEIF method in your unique desk, averaging from the “Days since earlier buy” column. For the above buyer ID (6564759437563), you must get 15.75 days.

As soon as extra, utilizing a fundamental segmentation, you could possibly do one thing like:

- Purchases not less than as soon as a month: 3.

- Purchases each 31 to 90 days: 2.

- Final bought earlier than that: 1.

Financial worth

Copy and paste your buyer IDs elsewhere, then deduplicate them once more.

Run one other AVERAGEIF method in your unique desk, averaging from the “Product sales (USD)” column. For the above buyer ID (6564759437563), you must get 87.43.

One final time, utilizing a fundamental segmentation:

- Common order worth > $200: 3.

- Common order worth between $150 and $200: 2.

- Common order worth under $150: 1.

About averages

I made this easy by utilizing common formulation. Naturally, relying in your business, buyer journey size, catalog dimension, and so forth., it could possibly be attention-grabbing to refine this additional utilizing the median (or percentiles) as a substitute of the imply (common).

What does the ultimate output seem like?

Now that you’ve all of your RFM scores calculated, merely run VLOOKUPs to get a desk of distinctive buyer IDs + their RFM scores.

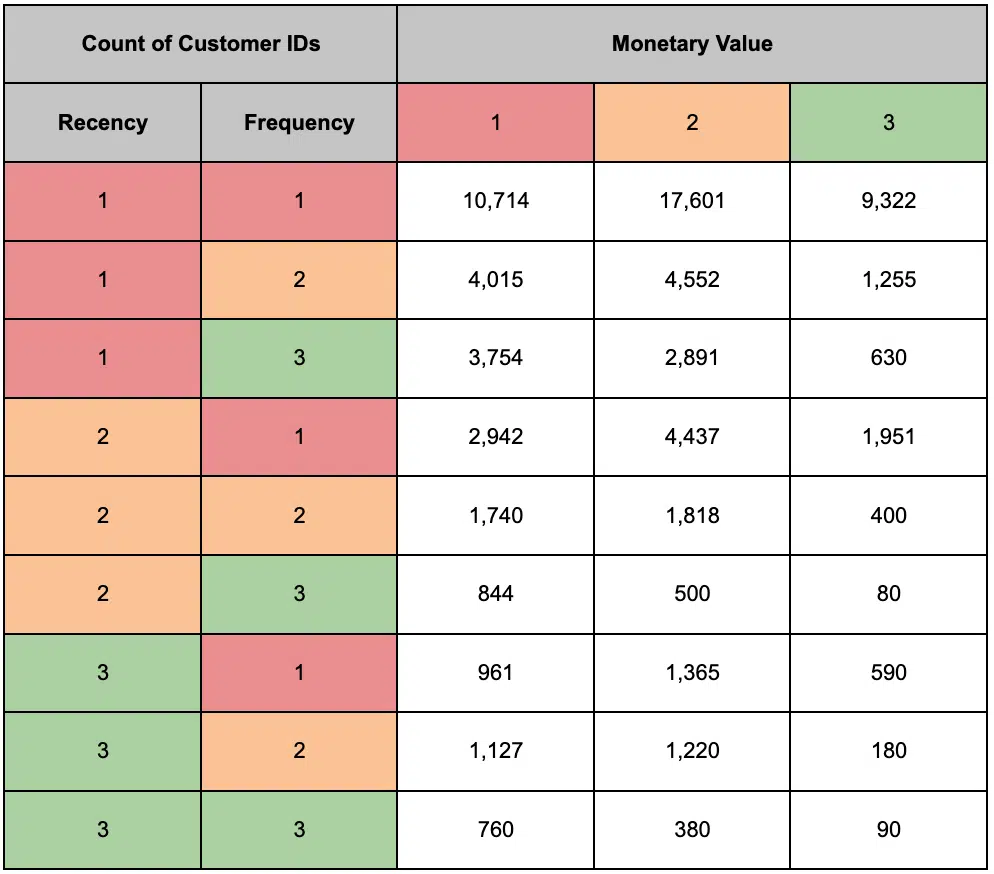

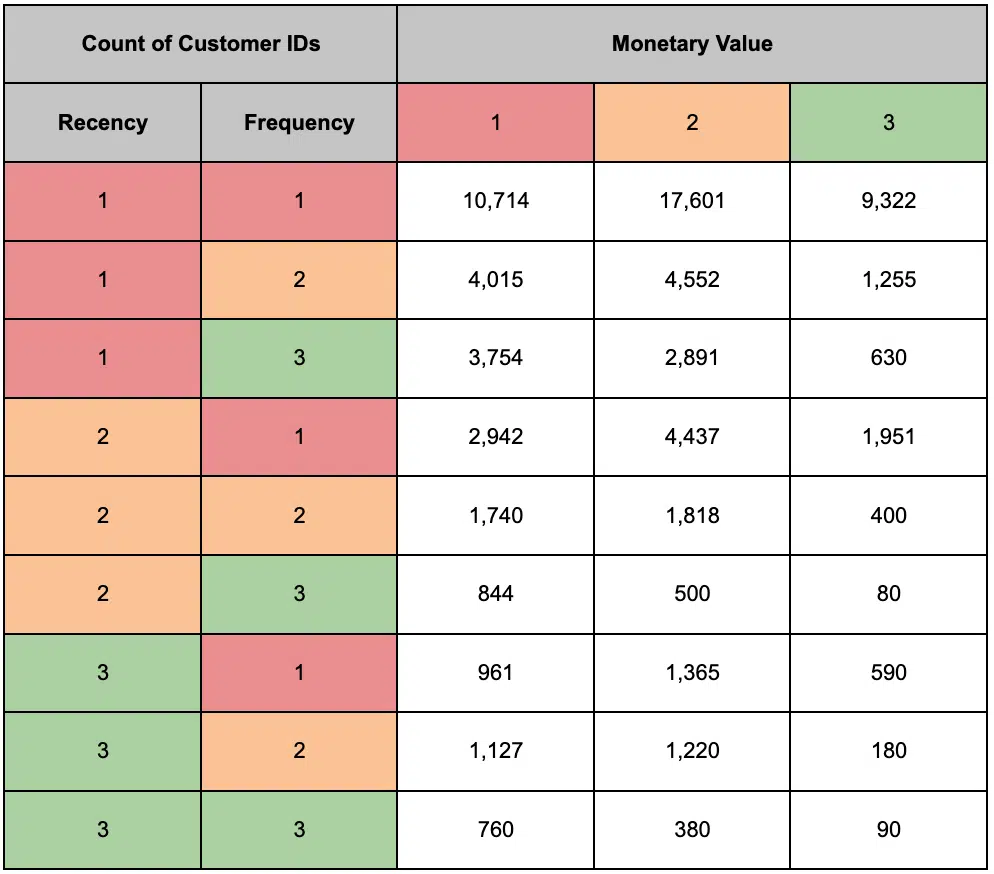

Most actually, you must find yourself with rather more 1s than 3s. Run a pivot desk to get an outline of your scoring distribution rapidly. It is best to get one thing like this:

As you possibly can see, some segments could also be too small to focus on successfully, so it’s necessary to dynamically modify your scoring system to make it extra usable on platforms like Google Adverts. Nevertheless, these smaller segments can nonetheless be beneficial for different techniques like electronic mail or SMS campaigns.

As an example, the “all-stars” phase (ranked 3 on all three RFM metrics) might solely include 90 clients, nevertheless it’s nonetheless value exploring, even when retargeting isn’t an choice.

One other method is to group RFM scores collectively. For instance, you possibly can mix segments with a complete RFM rating between 7 and 9, which may create a bunch of 4,830 buyer IDs. Whereas this reduces the granularity of your evaluation, it makes your insights extra actionable, particularly for advertisements or VIP campaigns.

With these refined buckets, the probabilities are limitless. You’ll be able to tailor goal audiences, craft customized messaging, and fine-tune your campaigns to maximise outcomes.

RFM segmentation: The important thing to smarter buyer concentrating on

RFM evaluation is an easy but efficient approach to phase clients based mostly on their shopping for habits.

By utilizing recency, frequency and financial worth scores, you possibly can improve retargeting campaigns, from segmentation to advert copy and product affords.

Whereas it might not be appropriate for each enterprise mannequin, RFM is an accessible and beneficial software value making an attempt.

Contributing authors are invited to create content material for Search Engine Land and are chosen for his or her experience and contribution to the search group. Our contributors work below the oversight of the editorial staff and contributions are checked for high quality and relevance to our readers. The opinions they categorical are their very own.