What in case your NFT campaign’s true efficiency lay not in transient floor-price actions however within the depth of neighborhood engagement and utility activation? Throughout our NFT drop evaluation, two clear patterns emerge: manufacturers that embed tangible perks—unique entry, gamified experiences, and real-world occasions—outperform mere JPEG launches, and influencer-driven activations orchestrated round key liquidity home windows maintain greater buying and selling volumes and royalty streams.

With that in thoughts, entrepreneurs are asking:

- How can we rework secondary-market information from passive indicators into proactive levers that feed immediately into influencer transient optimization?

- Which on-site and off-chain engagement developments predict mint conversion velocity earlier than worth spikes happen?

This text unpacks a holistic, data-driven framework—spanning major sale, secondary market, and neighborhood engagement—that empowers companies and types to measure success past flooring worth.

By aligning every KPI with focused influencer workflows, you’ll convert uncooked blockchain information into repeatable, scalable development engines that drive each monetary and brand-equity returns.

Defining True ROI in NFT Campaigns

In influencer-powered NFT activations, ROI have to be framed round three marketing campaign phases

- Consciousness Seeding

- Utility Activation

- Neighborhood Amplification

Every is pushed by tailor-made influencer briefs and KPIs.

Consciousness Seeding leverages tiered influencer tiers (macro, mid-tier, micro) with UTM-tagged drop hyperlinks to quantify carry in mint conversion. Utility Activation tracks influencer-led redemption behaviors (e.g., token-gated occasion RSVPs), whereas Neighborhood Amplification measures how influencer-sourced audiences interact with Discord, Twitter Areas, and secondary-market buzz.

Learn additionally:

Learn additionally:

This tripartite framework ensures each collaboration part—invitation, engagement, and advocacy—maps on to measurable monetary, engagement, and brand-lift outcomes, reworking nebulous floor-price chatter into structured efficiency insights.

In NFT campaigns, true ROI transcends mere worth appreciation and encompasses a multidimensional efficiency matrix that aligns with broader advertising and marketing aims. Monetary ROI should combine each major sale proceeds and ongoing royalty income, guaranteeing that preliminary mint income is augmented by cumulative secondary-market royalties with out overlooking gas-fee friction.

Equally important is model ROI: the diploma to which NFT initiatives bolster model fairness, improve share of voice, and generate incremental buyer acquisition. Conventional floor-price fixation obscures these dimensions, incentivizing speculative buying and selling over strategic utility.

From a marketer’s perspective, utility adoption charges function a number one success indicator. Monitor the proportion of holders who redeem on-chain perks—resembling entry to invite-only Discord channels or token-gated digital occasions—to measure the depth of engagement and predict long-tail income potential.

A excessive redemption fee usually correlates with stronger neighborhood advocacy, as community contributors convert digital possession into lively model ambassadorship.

Neighborhood ROI should quantify each quantitative development and qualitative sentiment. Leverage social-listening platforms to observe the trajectory of Discord member counts, every day lively customers, and sentiment polarity.

A sustained upward pattern in optimistic sentiment—pushed by clear roadmap updates, shock airdrops, or natural UGC—alerts sturdy neighborhood well being and mitigates churn danger. Conversely, spikes in adverse sentiment round perceived “rug pulls” or utility misfires demand speedy response by way of focused AMAs or compensation methods.

Channel ROI analysis calls for integration of on-chain analytics with off-chain engagement information. Correlate web-traffic carry from paid social adverts selling your NFT drop with on-chain mint conversion funnels. Analyze click-through charges on e mail blasts asserting whitelist openings, then map these clicks to mint transactions.

This convergence of Google Analytics and blockchain explorer information illuminates drop-week efficiency drivers and optimizes finances allocation throughout channels.

Model-lift measurement rounds out the ROI framework. Conduct pre- and post-campaign brand-lift research to evaluate shifts in unaided consciousness, buy intent amongst goal segments, and web promoter rating modifications attributable to NFT activations. If 20% of surveyed holders report elevated intent to buy core merchandise after minting, that uplift represents a quantifiable brand-equity acquire.

By deploying this influencer-aligned ROI framework, entrepreneurs can craft briefs that specify not solely aesthetic deliverables but in addition exact efficiency objectives—mint targets, utility redemptions, and community-growth benchmarks—for every influencer tier.

Companies and in-house groups acquire the flexibility to forecast income from royalty streams, optimize media budgets towards channels driving on-chain actions, and current govt stakeholders with a unified dashboard that ties influencer charges on to monetary, engagement, and brand-lift KPIs.

Finally, this stage of strategic readability transforms NFT launches from speculative gambles into scalable, repeatable activations that reinforce long-term model fairness throughout rising digital touchpoints.

Learn additionally:

Learn additionally:

Class 1: Main Sale Metrics

Profitable influencer-driven mint phases require a exact “Seed & Scale” playbook. In the course of the Seed part, allocate 10-15% of the full provide to tiered influencer cohorts—macro influencers obtain bespoke promo codes, mid-tiers share UTMs in carousel posts, and micro influencers drive neighborhood sign-ups by way of Discord invitations.

Scale part then unleashes broad influencer sweeps synchronized throughout channels, capitalizing on FOMO and social proof. To trace these cohorts, leverage an influencer CRM with on-chain attribution plug-ins.

Main sale metrics are the cornerstone of evaluating NFT marketing campaign success, capturing the efficacy of pre-launch demand era, mint execution, and preliminary income realization.

Mint Conversion Price

The primary important KPI is mint conversion fee, outlined because the ratio of distinctive pockets visits to precise mint transactions. Excessive conversion charges replicate seamless UX, compelling utility propositions, and well-targeted demand channels. To calculate this, combine on-chain mint logs with front-end analytics: divide whole mints by distinctive visits to your mint touchdown web page.

Common Mint Value

Subsequent, the common mint worth reveals income optimization for tiered-utility drops. If early-bird tiers promote out inside minutes at a premium worth level, it demonstrates each scarcity-driven demand and willingness to pay.

Monitor how every tier performs—gold, platinum, and ultra-elite—in actual time, utilizing smart-contract occasion listeners. Variance in sell-out velocity throughout tiers helps refine future pricing constructions and shortage controls.

Promote-By means of Price (STR)

Promote-through fee is one other indispensable metric: the proportion of whole provide bought within the preliminary window (e.g., first 24 hours). A suboptimal sell-through alerts demand fatigue or inadequate pre-drop engagement, warranting changes to whitelist quantity, influencer seeding, or utility roadmap readability. Manufacturers ought to intention for a minimum of 70–80% sell-through inside the first 24 hours to maximise hype momentum and social proof.

Whitelist-To-Mint Ratio

Whitelist-to-mint ratio tracks the effectivity of your whitelist technique. A excessive ratio means whitelist members are genuinely , not simply chasing free spots. Low ratios might point out over-saturation or misaligned focusing on. Refining standards—resembling requiring social-proof duties or micro-influencer referrals—can enhance whitelist high quality.

Learn additionally:

Learn additionally:

@web3m What’s a “Whitelist” within the NFT world?🤔 #whitelist #nftexplained #nftcommunity #whatisnft #web3explained

Fuel Value Optimization

Fuel price optimization additionally impacts major sale ROI. Monitor common fuel charges paid by customers throughout mint versus market medians. Extreme fuel prices can deter conversions; contemplate implementing gas-station instruments or layer-2 options to reduce friction.

On the spot Secondary Curiosity

Lastly, seize on the spot secondary curiosity by measuring post-mint itemizing exercise. If a big share of newly minted NFTs are instantly relisted, that will sign short-term flips somewhat than long-term holder intent. Whereas secondary flips aren’t inherently adverse, a balanced ratio—say, 20–30% on the spot relisting—signifies each liquidity provision and holder conviction.

To operationalize influencer mint referrals at scale, combine a devoted Influencer-Mint Module so each promo code and UTM hyperlink auto-syncs with on-chain occasions. Pair this with Discord Bot automations (e.g., Collab.Land) to automate whitelist allocation and real-time badge project for profitable referrals.

For post-launch evaluation, make use of a unified dashboard—in-built instruments like Tableau or Dune Analytics—that ingests influencer cohort information, on-chain mint logs, and front-end clickstreams. This setup empowers marketing campaign managers to determine top-performing collaborators, reallocate finances mid-campaign, and refine transient templates for future drops, closing the loop between influencer effort and first sale efficiency with out handbook information stitching.

Learn additionally:

Learn additionally:

Secondary Market Metrics

Secondary-market metrics aren’t simply passive reflections of drop efficiency—they’re actionable alerts that ought to immediately inform your influencer marketing campaign lifecycle.

By aligning post-mint influencer activations with secondary liquidity waves, you may convert transient hype into sustained engagement and royalty income. This strategic alignment requires entrepreneurs to choreograph influencer content calendars—scheduling price-check movies, unboxing streams, and unique secondary-market AMAs—exactly when the bid–ask unfold is narrowing and buying and selling quantity is poised to spike.

Embedding these actions into influencer briefs transforms secondary-market information from retrospective KPIs into forward-looking levers for finances reallocation, collaborator tiering, and real-time inventive adaptation.

Complete Buying and selling Quantity

Measures mixture commerce worth throughout secondary marketplaces inside outlined intervals (e.g., 24-, 72-, and 168-hour home windows). Phase quantity spikes by influencer cohort utilizing hashed referral hyperlinks embedded in secondary-listing alerts.

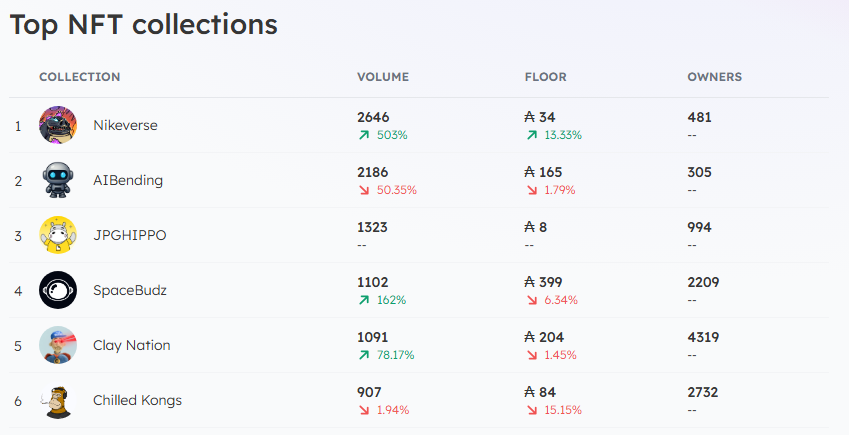

For instance, the Nikeverse NFT assortment has, on the time of writing, a +503% 24-hour buying and selling quantity on secondary marketplaces like JPG. Retailer (unique for the Cardano community). This alerts a robust curiosity within the assortment. As compared, the AIBending NFT assortment has a -50% 24-hour buying and selling quantity, signaling a lower in curiosity within the assortment.

Supply: JPG.Retailer

Distinctive Merchants & Pockets Progress

Monitor net-new addresses interacting along with your assortment post-launch; correlate influxes with particular influencer activations (e.g., mid-tier influencer drops of unboxing clips). A rising unique-trader rely signifies broadened market attraction instigated by influencer audiences.

Royalty Revenue & Cumulative Secondary Income

Mixture smart-contract royalty occasions to quantify income streams accruing to the model or artist. Drill down royalties by market (OpenSea, LooksRare) and overlay influencer-promotion timelines to determine which collaborators drive the best royalty yield.

Ground Value Dynamics vs. Unfold

Monitor the divergence between low‐finish listings and bid costs to judge market depth. Encourage influencers to publish “price-check” content material throughout low-spread durations, incentivizing viewers bids and narrowing the bid–ask hole for improved worth stability.

By embedding secondary-market insights into your influencer marketing campaign suggestions loop, you acquire real-time visibility into which creators catalyze probably the most impactful liquidity surges and royalty accruals.

This intelligence permits entrepreneurs to dynamically reallocate budgets, escalating high-performing influencers for subsequent phases, scheduling focused “liquidity boosts,” and refining transient templates to emphasise content material codecs that traditionally drive secondary quantity and secure flooring costs.

Over time, this iterative method composes a playbook of best-in-class influencer activations, guaranteeing that every cohort’s inventive output immediately correlates with measurable monetary and engagement outcomes, securing sustainable ROI for each major and secondary-market efficiency.

Learn additionally:

Learn additionally:

Neighborhood Engagement Metrics

In NFT campaigns powered by influencers, neighborhood engagement is the nucleus that binds holders, fuels UGC amplification, and underwrites long-term worth creation. Influencer briefs should due to this fact transcend transactional promotion, tasking creators with seeding tactical touchpoints like Discord deep dives, co-hosted Twitter Areas, and UGC challenges that highlight token utilities.

By weaving community-focused deliverables into each transient—full with quantifiable objectives and content material frameworks—you make sure that every influencer activation not solely broadcasts your drop however cultivates the sustained human connections important for retention, advocacy, and secondary-market vibrancy.

Energetic Neighborhood Dimension

Monitor development in goal channels—Discord, Telegram, Twitter Areas—attributable to influencer referrals. Use invite-specific hyperlinks or Discord bots that observe sign-ups by collaborator. A vibrant, increasing neighborhood signifies profitable influencer conversion of audiences into engaged holders.

Engagement Velocity & Retention

Calculate the ratio of returning contributors to new joiners in your major neighborhood channels over 7- and 14-day cohorts. Overlay these cohorts with influencer activation dates to find out which creators foster stickiness and drive repeat interactions (polls, drop predictions, utility redemptions).

Occasion & Utility Redemption Charges

Assess participation in token-gated occasions—each digital and IRL—by measuring RSVP-to-attendance ratios and post-event suggestions volumes. Leverage on-chain proof-of-attendance to quantify what number of holders (sourced by way of influencer campaigns) interact with branded experiences, reinforcing utility as a retention lever.

When neighborhood metrics are surfaced alongside influencer efficiency information in a centralized dashboard, entrepreneurs can exactly determine which creators excel at neighborhood stimulation, whether or not by way of excessive RSVP conversion, peak AMA engagement, or superior retention cohorts.

This readability means that you can iterate on transient constructions—reallocating sources to influencers whose content material fosters the deepest connections, co-developing new utility-driven UGC campaigns, and designing phased activations that construct progressively richer neighborhood experiences.

Finally, this data-informed method transforms neighborhood engagement from a smooth metric right into a strategic asset, driving greater mint conversions, elevated royalty streams, and enduring model loyalty inside your NFT ecosystem.

Learn additionally:

On-Website and Off-Chain Engagement

On-site and off-chain engagement metrics illuminate the exact touchpoints the place creator audiences work together with model belongings, bridging the hole between social buzz and on-chain motion.

By integrating UTM-tracked hyperlinks in influencer content material, entrepreneurs can dissect each stage of the conversion funnel: from click-through on a mint announcement, by way of exploratory roadmap web page visits, to wallet-connect makes an attempt.

Concurrently, off-chain alerts—e mail open charges, web site dwell time, and social share velocity—function early-warning indicators of friction or hype fatigue. Embedding these metrics into influencer briefs empowers groups to optimize content material timing, refine focusing on layers, and allocate media {dollars} towards channels that demonstrably drive on-chain conversions.

Site visitors Supply Attribution

Deploy granular UTM parameters in each influencer asset—story swipe-ups, link-in-bio posts, and affiliate deposit prompts—to map conversion paths from particular creators to mint web page visits. Mix these with real-time dashboards (e.g., Phase + Dune integration) to attribute mint transactions again to influencer cohorts and alter transient ways mid-campaign.

On-Web page Engagement

Monitor key behavioral metrics in your mint touchdown web page: time on web page, scroll depth (e.g., roadmap engagement), and click-map warmth zones. Influencer briefs ought to embrace A/B testing of hero inventive and utility explainer placement, with predetermined thresholds (e.g., 60% scroll depth) that set off speedy inventive swaps or hyperlink refinements.

E mail & Push Notification Efficiency

Embed influencer-exclusive promo codes in drip sequences despatched to pre-signup audiences. Monitor open charges, click-through charges, and subsequent pockets connections to gauge influencer content material resonance. Excessive open-to-mint conversion alerts that creator messaging aligns with viewers intent, informing future transient messaging hierarchies.

Social Share & Virality Velocity

Use social listening instruments (Brandwatch, Sprout Social) to quantify share counts, hashtag mentions, and engagement velocity for influencer-generated content. Correlate peaks in virality velocity with on-site conversion spikes to determine which narrative angles—utility demos, unboxings, AMAs—finest drive cross-channel amplification.

By systematically linking UTM-tagged influencer posts, on-site behavioral analytics, and off-chain engagement alerts to on-chain mint actions, entrepreneurs acquire a closed-loop view of marketing campaign efficiency.

This empowers speedy iteration of influencer briefs—shifting focus to top-performing content material codecs, optimizing call-to-action placement, and reallocating finances to creators whose audiences display the strongest funnel development.

Over successive drops, this data-driven methodology delivers compounding ROI by fine-tuning focusing on precision, inventive sequencing, and cross-channel amplification ways—reworking ephemeral hype right into a sustainable development engine.

Synthesizing Metrics into Scalable NFT Campaigns

NFT drop success calls for greater than fleeting floor-price spikes. By integrating primary-sale, secondary-market, neighborhood, on-site/off-chain, and brand-lift metrics right into a unified framework, entrepreneurs convert uncooked information into strategic insights.

Every KPI—mint conversion fee, royalty yield, Discord retention, UTM attribution, and sentiment carry—serves as a directional beacon for refining influencer briefs, reallocating budgets, and optimizing inventive cadences. This closed-loop methodology transforms your creator community right into a dwelling development engine, able to sustaining engagement, amplifying model fairness, and unlocking ongoing income streams.

As you iterate, the playbook of best-in-class activations emerges: tiered collaborator fashions, timed content material surges, and utility-driven UGC challenges. Finally, this disciplined, data-driven method elevates NFT campaigns from speculative drops to repeatable, scalable advertising and marketing autos—bridging rising Web3 channels with confirmed influencer-marketing rigor and delivering measurable ROI for companies and types alike.

Continuously Requested Questions

What platform ought to I take advantage of to streamline minting and seize primary-sale conversion information?

Contemplate a turnkey resolution just like the NFT Makers suite, which affords built-in analytics for mint conversion fee, gas-fee monitoring, and UTM-tag integration—letting you attribute primary-sale efficiency on to particular influencer cohorts.

How can I gauge secondary-market momentum in sports-focused NFT campaigns?

Leverage analytics from main Sport NFT Marketplaces that report buying and selling quantity by crew or participant assortment, enabling you to correlate post-mint influencer activations with spikes in bid–ask unfold and whole commerce worth.

Which NFT marketplaces present sturdy dashboards for end-to-end marketing campaign monitoring?

Platforms just like the NFT Marketplace information spotlight marketplaces—OpenSea, Rarible, LooksRare—with on-chain dashboards and webhook integrations to feed your BI instruments and observe each major and secondary KPIs in actual time.

Can “.eth” or branded NFT domains amplify your influencer-driven engagement metrics?

Integrating NFT Domains into your marketing campaign—by issuing token-gated subdomains for whitelist entry—helps you to observe distinctive visits, badge redemptions, and utility activation tied to every influencer’s referral hyperlink.

What’s the function of collection-generator instruments in scaling influencer drop campaigns?

Utilizing an NFT Collection Generator accelerates batch mint workflows and standardizes metadata, whereas built-in CSV export of token IDs helps you to map mints again to particular influencer promo codes for cohort-level conversion evaluation.

How do real-estate NFT platforms measure utility engagement in another way?

Actual-estate NFT Companies usually embrace on-chain deeds or digital walkthrough entry; you observe RSVP-to-attendance ratios and token-gated property views as utility redemption charges—offering deeper holder-engagement insights than pure token transfers.

Which engagement metrics matter most for NFT recreation collaborations?

On NFT Games, measure in-game asset utilization, level-completion charges, and secondary trades of recreation NFTs—then align these with influencer UGC streams to determine which creators drive the best play-to-earn conversion.

How can music NFT marketplaces inform royalty and brand-lift monitoring?

Platforms just like the Music NFT Marketplace present royalty-split studies and listener engagement stats, enabling you to correlate influencer-led drop bulletins with spikes in play counts, secondary gross sales, and ensuing royalty earnings.