The influencer advertising and marketing world is booming, and with it, the non-public finance sector is tapping into the facility of ‘finfluencers’ to achieve new heights. As the worldwide influencer market is ready to hit a staggering $32.55 billion by 2025, the expansion in monetary content material is outpacing the remainder, with monetary influencers on Instagram and YouTube experiencing double the expansion of their friends.

However the influencer panorama is shifting. Gone are the times of flaunting extravagant life; audiences are in search of genuine, relatable content material. This implies manufacturers should adapt, creating platform-specific content material that resonates with audiences on TikTok and Instagram Reels.

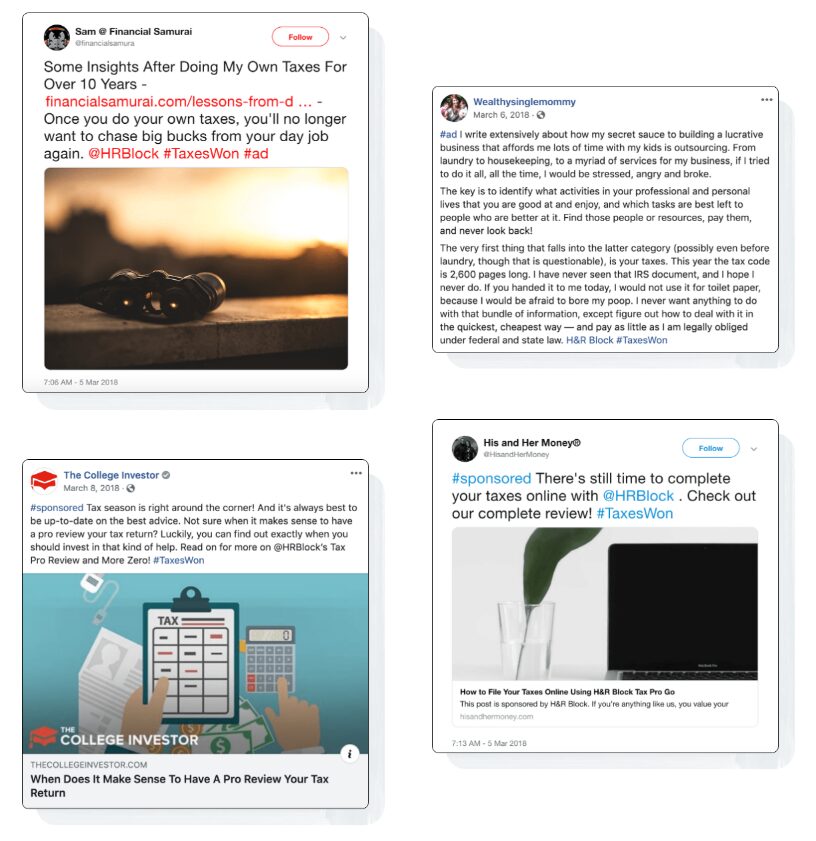

So, how are manufacturers navigating this new wave of authenticity? Take H&R Block’s Tax Professional Go Evaluate marketing campaign, for instance. An ideal mix of focused influencer choice and inventive freedom, the marketing campaign proved that when performed proper, influencer advertising and marketing within the finance world can result in spectacular outcomes.

Maintain studying to see how this marketing campaign unfolded and uncover different game-changing campaigns shaping the non-public finance instruments business!

1. H&R Block’s Tax Professional Go Evaluate: An Influencer Marketing campaign That Filed for Success

When H&R Block launched its Tax Professional Go Evaluate, they confronted a essential problem: getting the phrase out about their new service earlier than the 2018 tax season got here to a detailed. Conventional promoting wasn’t going to chop it—too expensive, too sluggish, and never precisely on model for the viewers they wanted to achieve.

Enter NeoReach and their influencer marketing strategy that proved, as soon as once more, {that a} rigorously crafted marketing campaign cannot solely increase consciousness but additionally drive actual, measurable outcomes.

Strategic Strategy

-

Focused Influencer Choice: 36 finance-focused influencers, tapping right into a mature, financially savvy viewers. Millennials and Gen-Xers had been the main focus—individuals who’d slightly learn an in depth weblog put up than swipe via Instagram Stories.

-

Platform Focus: Fb, Twitter, and blogs had been the chosen battlegrounds. These platforms catered to the core viewers that was already participating with content material about taxes and monetary literacy.

-

Content material Freedom: Influencers got inventive freedom to showcase how H&R Block’s Tax Professional Go service solved actual issues—customized, cost-saving, and handy. The outcomes? Real, participating content material that resonated.

Marketing campaign Affect

By strategically leveraging influencer content material, H&R Block reached over 4 million impressions, with a stellar 17.5% engagement charge—a quantity that stands out within the often-dry world of tax preparation.

The influencers didn’t simply speak concerning the product; they engaged their followers in full of life conversations about tax prep, a subject most individuals would slightly keep away from just like the plague. But, the conversations had been informative, genuine, and finally led to greater than 6,000 engagements, a quantity that instantly impacted gross sales because the tax season was winding down.

Supply: NeoReach

The Numbers Inform the Story

-

Whole Impressions: 4 million+

-

ROI: A stable 3:1 ratio based mostly on influencer media worth, a testomony to the marketing campaign’s effectivity.

-

Demographics: The marketing campaign was spot on, with 94% of followers being married (hey, joint tax submitting) and 75% within the 30-49 age vary—prime Tax Professional Go territory.

-

Viewers Pursuits: The majority of the engaged viewers had pursuits in information, enterprise, and tech, the very individuals who would respect a streamlined tax resolution.

NeoReach didn’t simply ship influencers to the battlefield—they geared up them with the instruments to win. By choosing bloggers and content creators with deep information of non-public finance, the marketing campaign gained credibility from the get-go. Influencers like Monetary Samurai, The School Investor, and Rich Single Mommy lent their experience, guaranteeing the message reached the best ears.

The fantastic thing about this marketing campaign? It wasn’t about flashy posts or viral stunts. It was about talking to an viewers that wanted actual, actionable data in a format they trusted. And it labored—H&R Block’s new service turned a success, with optimistic interactions translating instantly into elevated gross sales and long-term model loyalty.

2. From Zero to Unicorn: How CRED’s Influencer Magic Constructed a $2.2 Billion Model

CRED, a fintech platform based in 2018, has skyrocketed to unicorn standing in simply three years, with a valuation of $2.2 billion and over 16 million customers. Whereas its enterprise mannequin, which rewards well timed bank card funds, turned the idea of credit score scores on its head, it was CRED’s savvy use of influencer marketing that actually supercharged its success.

Here is a better take a look at how they’ve mastered the artwork of branding, influencer partnerships, and a little bit of viral PR magic alongside the way in which.

Strategic Strategy

-

Branding with Function: CRED’s model pillars—belief, exclusivity, and innovation—are the spine of its advertising and marketing technique. By emphasizing belief (by way of excessive credit score rating necessities for membership), they guarantee a neighborhood of accountable monetary gamers. Exclusivity provides status, and innovation retains the choices recent with options like CRED Stash and CRED Mint.

-

Influencer Partnership with Precision: CRED’s influencer advertising and marketing isn’t about plastering the platform throughout each nook of the web. It’s about strategic collaborations with celebrities like Rahul Dravid and Virat Kohli, who converse to various audiences. From cricket legends to Bollywood icons, CRED’s influencer partnerships have been something however typical.

-

PR Stunts and Social Media Savvy: CRED mixes influencer advertising and marketing with inventive PR stunts, akin to sending hammers to influencers earlier than Black Friday, teasing them to destroy their present watches and telephones. It’s an attention-grabbing tactic that stirs curiosity, will increase engagement, and strengthens model presence.

Marketing campaign Affect

CRED’s influencer campaigns have sparked viral moments that not solely have interaction customers but additionally construct deep belief and model loyalty. The marketing campaign that includes Rahul Dravid, the place the normally calm cricketer had a street rage second, went viral throughout social media, producing large buzz. By portraying celebrities in surprising eventualities, CRED turns the bizarre into the extraordinary—one thing that makes their model memorable.

The Numbers Converse

With over 16 million customers and speedy progress, CRED’s influencer technique has been a major driver. The usage of high-profile influencers helped CRED attain broader demographics, from the younger, aspirational crowd to the older, extra financially accountable segments.

The Takeaway

CRED’s success isn’t nearly providing a wise product; it’s about creating a life-style model that individuals need to be a part of. By partnering with the right influencers, creating campaigns that break the mildew, and tapping into cultural touchpoints, CRED’s advertising and marketing is a masterclass in how fintech can do extra than simply handle cash—it could possibly seize the hearts and a spotlight of thousands and thousands.

Enhance Your FinTech Software with Influencer Advertising and marketing Campaigns!

Click on beneath to find how high FinTech instruments are partnering with influencers to drive model consciousness and buyer belief. Study the methods behind probably the most profitable campaigns which are serving to these manufacturers have interaction their viewers and simplify monetary administration.

Top FinTech Influencer Marketing Campaigns

3. L&T Finance’s Two-Wheeler Mortgage Marketing campaign: Accelerating Engagement with Influencer Energy

L&T Finance, a number one non-banking monetary firm in India, had a easy but bold purpose: make two-wheeler loans the speak of the city. Their recent influencer marketing campaign, centered round selling reasonably priced and hassle-free loans for bikes and scooters, did simply that — and extra.

With a well-oiled technique that blended native taste, relatable content material, and celeb enchantment, the marketing campaign revved up L&T Finance’s model presence in Kolkata, driving consciousness and engagement like a turbocharged engine.

Strategic Strategy

-

Focused Influencer Choice: L&T Finance knew their viewers effectively: younger, dynamic people aged 20-40, dwelling in a fast-paced metropolis like Kolkata. They rigorously chosen influencers with a powerful native following, guaranteeing their content material resonated with the goal demographic. These influencers weren’t simply well-liked—they had been trusted figures locally, giving the marketing campaign an genuine, relatable contact.

-

Native Relevance: By incorporating real-time experiences at native dealerships into influencer content material, L&T Finance created an immersive and plausible narrative. Viewers weren’t simply listening to about two-wheeler loans—they had been seeing them in motion. This real-world connection strengthened the model’s enchantment, making the mortgage course of really feel extra accessible.

-

Superstar Collaboration: The cherry on high? Bike life-style influencer and journey vlogger Mouna Nanaiah went to the IBW2024 bike occasion and created movies by the L&T Finance sales space, explaining their two-wheeler loans.

Marketing campaign Affect

The outcomes converse for themselves. With a complete attain of 997,853 and over 1.1 million views, L&T Finance captured the eye of their audience. Engagement numbers had been equally spectacular, with 81,501 likes, 419 feedback, and 1,013 shares.

The usage of each Instagram and YouTube helped diversify content material codecs, reaching audiences throughout numerous platforms with completely different content material consumption preferences.

The strategic integration of Mouna Nanaiah amplified the marketing campaign’s visibility, serving to L&T Finance stand out within the aggressive monetary companies sector. Her presence added star energy whereas holding the message grounded in belief and native relevance—a necessary aspect when advertising and marketing one thing as private as a mortgage.

The Takeaway

L&T Finance’s marketing campaign was a well-calculated mix of influencer advertising and marketing and celeb clout, proving that success within the monetary sector isn’t nearly numbers—it’s about constructing belief and relatability. By aligning their message with influencers who genuinely resonated with their goal demographic, L&T Finance turned an earthly monetary product into an aspirational buy.

In an area dominated by generic adverts, this marketing campaign’s authenticity and native relevance helped it break via the noise and make an impression that caught.

4. Future Generali: Breaking the Stigma, One Submit at a Time

Relating to elevating consciousness about psychological well being, the same old strategy tends to be a whole lot of speaking and little or no engagement. However Future Generali’s campaign for World Psychological Well being Day was a game-changer, utilizing influencer energy to not solely spark conversations but additionally drive actual interplay with their viewers.

Strategic Strategy

-

Micro-Influencer Magic: As an alternative of counting on a handful of massive names, Future Generali took a micro-influencer marketing strategy. With 22 influencers spanning well being, wellness, health, and leisure niches, the model made certain to achieve a broad but focused viewers. It’s like enjoying chess with a military of pawns that transfer quick and strategically—besides on this case, they’re throughout Instagram and Twitter, creating actual buzz round psychological well being.

-

Superstar Backing: Whereas the micro-influencers dealt with the intimate, private contact, the marketing campaign nonetheless performed its ace card with macro influencers. Celebrities like Shilpa Shetty and Mandira Bedi lent their names to the trigger, boosting the marketing campaign’s credibility and attain. Their involvement was the proper mix of authenticity and authority, bringing the marketing campaign into mainstream discussions whereas additionally holding it relatable.

-

Interactive Engagement: What actually set this marketing campaign aside from the noise of generic psychological well being consciousness campaigns was the interactive aspect. The “Whole Well being Rating” check on Future Generali’s web site was a stroke of genius, permitting the viewers to evaluate their very own psychological well being and really feel like they had been a part of the dialog. Influencers even shared their not-so-perfect scores, making the marketing campaign really feel inclusive slightly than preachy. It’s the digital model of “Hey, we’re all on this collectively.”

Marketing campaign Affect

-

Attain: 476.5K folks in 4 days. That’s like having your psychological well being message blasted to a stadium of individuals—and it was all performed organically, due to these influencers.

-

Engagement: With a 2.36% engagement charge, the marketing campaign did not simply attain folks; it resonated with them. That is a stable determine within the influencer advertising and marketing world, particularly while you’re coping with a delicate topic like psychological well being.

-

Hashtag Energy: #healthinsideout and #TotalHealthScore turned the marketing campaign’s rallying cry. It’s no shock that the conversations these hashtags generated weren’t simply concerning the marketing campaign—they had been about normalizing psychological well being discussions in actual life.

The Takeaway

Future Generali’s marketing campaign didn’t simply create consciousness about psychological well being; it made folks really feel like they had been a part of a motion. By participating influencers from various fields and giving the viewers a platform to evaluate their very own psychological well being, the marketing campaign achieved one thing uncommon: it made psychological well being really feel approachable and vital.

Within the crowded house of World Psychological Well being Day content material, this marketing campaign stood out not by being louder however by being smarter.

5. FinTron’s Finance App: Turning TikTok right into a Monetary Powerhouse

When FinTron got down to train Gen Z handle their cash, they didn’t simply put up a few adverts and hope for the very best. No, they went straight to the supply—the guts of viral content material on TikTok.

Teaming up with The Influencer Marketing Factory (IMF), they unleashed a wave of financial wisdom that went viral and shook up the app’s algorithm, leading to a whopping 5.6 million views. How’s that for getting cash transfer?

Strategic Strategy

-

Finance Meets Enjoyable: FinTron’s technique was clear: generate profits administration accessible and enjoyable. To do that, they enlisted a number of the most influential voices within the private finance house on TikTok—folks like @nicktalksmoney, @pricelesstay, and @yourrichbff. These influencers are extra than simply finance gurus; they’re the cool children on the monetary desk, making investing, saving, and budgeting sound like a dialog at your favourite café. By partnering with these TikTok stars, FinTron obtained to faucet into their established belief and credibility with a youthful, finance-hungry viewers.

-

Participating Content material: The influencers didn’t simply speak concerning the app—they confirmed it in motion. With their easy-to-follow tutorials and relatable recommendation, the influencers created academic content material that felt much less like a gross sales pitch and extra like an invitation into their monetary world. Watching a TikTok video about budgeting won’t sound riveting at first, however when it’s delivered with the persona and perception of somebody like @yourrichbff (a Wall Avenue professional and NYT Bestseller), it’s onerous to scroll previous.

-

Hashtag Campaigns That Stick: With over 6 million complete hashtag attain and a devoted hashtag that trended all through the marketing campaign, FinTron was in a position to create an area the place customers didn’t simply watch—they participated. Viewers shared their very own experiences and recommendation, producing buzz and lengthening the marketing campaign’s lifespan far past the influencer posts.

@fintroninvest On the lookout for an all-in-one finance app? Look no additional! FinTron’s obtained you coated. From Monetary Literacy Classes to Automated Investments, earn factors whereas investing in your future. #FinTron #money #Finance #budgeting #savingmoney #investing # studying #personalfinance #financialliteracy #cash #points #rewards #goals ♬ original sound – FinTron

Marketing campaign Affect

-

Large Attain: The marketing campaign wasn’t simply seen—it was felt. With 5.6 million TikTok views and 289k likes, FinTron’s app turned part of the monetary dialog, one TikTok at a time. The overall mixed followers of all of the influencers concerned? 12.6 million. That’s an viewers larger than some nations.

-

Engagement Via the Roof: With 2,377 shares, the marketing campaign not solely sparked curiosity however inspired customers to move the data alongside to their networks, making it a real viral success. On the earth of finance, the place content material can usually be dry, FinTron proved that studying handle your cash can truly be thrilling.

The Takeaway

In a sea of non-public finance apps, standing out is not any straightforward feat. However FinTron cracked the code by leveraging the facility of TikTok influencers who made private finance really feel each related and enjoyable. By tapping into the TikTok universe, the place short-form videos reign supreme, FinTron not solely elevated app downloads but additionally created a buzz that had folks speaking—and sharing.

6. Safety Financial institution: Amplifying Financial savings with Influencer Energy

When Safety Financial institution got down to promote its high-interest financial savings account, they didn’t simply depend on the standard monetary jargon and stiff brochures. As an alternative, they turned to the affect of social media, tapping into the powerhouse of YouTube, Instagram, and TikTok to generate buzz and pleasure round their providing.

By partnering with the best influencers via Narrators, they reworked what may have been a dry financial savings pitch right into a marketing campaign that had folks not simply paying consideration however participating.

Strategic Strategy

-

Multi-Channel Energy Play: Safety Financial institution didn’t simply stick to at least one platform—this was an all-out influencer takeover. By collaborating with 21 influencers throughout YouTube, Instagram, and TikTok, they had been in a position to goal completely different segments of the viewers. Whether or not it was the deep dive on YouTube or the short TikTok scroll, every platform introduced a singular benefit to the desk, guaranteeing that the marketing campaign reached its audience wherever they had been.

-

Influencer Variety: The fantastic thing about this technique was the variety of influencers concerned. By working with a spread of personalities who resonated with completely different demographics, Safety Financial institution was in a position to not solely improve attain but additionally make their high-interest financial savings account really feel accessible and related to a wider group. In any case, nothing says “reliable” fairly like listening to a couple of monetary product from a face you already know and comply with.

-

Engagement at its Core: The purpose was clear—create widespread consciousness and drive engagement. And boy, did it work. These influencers didn’t simply speak concerning the product; they made their followers assume, ask questions, and take motion.

Marketing campaign Affect

-

Attain and Engagement: 121K engagements isn’t only a quantity—it’s a testomony to how effectively the marketing campaign resonated with audiences. With 21 influencers bringing their credibility to the desk, the high-interest financial savings account turned greater than a product; it turned a dialog. The complete follower depend of 600K speaks volumes concerning the potential scale Safety Financial institution tapped into by diversifying platforms and influencer sorts.

-

Widespread Consciousness: Safety Financial institution efficiently achieved its major goal—making a buzz round their providing and ensuring folks took discover. Whether or not it was via an informal Instagram story, an in-depth YouTube video, or a enjoyable TikTok put up, the message was clear: this financial savings account isn’t simply one other product—it’s the sensible option to save.

@securitybankph With simply PHP10,000 you may open a financial savings account with Safety Financial institution’s Cash Builder Financial savings Account in your emergency fund, a financial savings account that constantly rewards you as your cash grows 💚💙 Open an account on-line by way of www.securitybank.com/tkMB-NicoleOh #BetterBanking #SecurityBank #MoneyBuilder #savingmoney #financetiktok #banksph #highinterestrates #passiveincome ♬ original sound – Security Bank PH

The Takeaway:

If you wish to make a monetary product stand out, make it enjoyable—and get influencers in your aspect. Safety Financial institution’s multi-platform technique demonstrated that with the best influencers, even a product like a high-interest financial savings account can spark an actual dialog. So, the subsequent time you assume your providing is simply too “boring” to market, simply keep in mind: with the best technique, you may flip financial savings right into a development.

Private Finance Instruments: Innovating Engagement and Belief within the Digital Age

Throughout these campaigns, profitable methods included multi-channel influencer engagement, making finance really feel accessible, and sparking interactive conversations. Manufacturers that embraced various influencers, built-in viewers participation, and used viral developments noticed standout outcomes.

The non-public finance sector continues to evolve with elevated concentrate on digital engagement and trust-building. Manufacturers ought to experiment with interactive content material and cross-platform campaigns to remain related on this rising house. The longer term is digital, social, and interesting.

Incessantly Requested Questions

What’s influencer advertising and marketing in private finance?

Influencer advertising and marketing in private finance includes partnering with influencers—people with a major on-line following—to advertise monetary instruments and companies, akin to budgeting apps or funding platforms, to their viewers.

How do influencers influence private finance instruments?

Influencers can construct belief and credibility, making monetary instruments extra relatable and accessible to their followers. Their endorsements can simplify complicated monetary ideas and encourage adoption of those instruments.

Why ought to monetary manufacturers use influencer advertising and marketing?

Influencer advertising and marketing helps monetary manufacturers attain a focused viewers, construct belief, and educate customers on monetary merchandise. It may possibly additionally simplify complicated monetary ideas and improve engagement with potential customers.

What varieties of influencers are greatest for selling finance instruments?

Micro and nano-influencers, who’ve smaller however extremely engaged audiences, are sometimes more practical for selling finance instruments. They have an inclination to have larger engagement charges and may present extra customized suggestions.

How can I measure the success of an influencer marketing campaign?

Success could be measured via key efficiency indicators (KPIs) akin to engagement charges, click-through charges, conversion charges, and return on funding (ROI). Monitoring these metrics helps assess the effectiveness of the marketing campaign.

What are the authorized issues when working with influencers?

It is vital to make sure that influencers adjust to rules, akin to disclosing sponsored content material as per FTC tips. Monetary product promotions are sometimes regulated by exterior companies, together with authorities organizations just like the FDIC, FTC, and SEC.

How do I select the best influencer for my marketing campaign?

Choose influencers whose viewers demographics align along with your goal market. Take into account their content material model, engagement charges, and authenticity. Instruments like influencer marketing platforms can help in figuring out appropriate influencers.

What content material codecs work greatest for selling finance instruments?

Instructional content material, akin to tutorials, opinions, and private finance suggestions, tends to resonate effectively. Brief-form movies on platforms like TikTok and Instagram Reels are notably efficient for participating audiences.